Join us on our Social Media

platforms to learn and grow with Smart Success Healthcare

We help Physical Therapists, Occupational Therapists, Dietitians and Chiropractors achieve multi 6 to 7 figures per month with few staff, happy patients and great results!

Financial 101: The Talk You Should’ve Got in 4th Grade (But Didn’t)

Financial 101: The Talk You Should’ve Got in 4th Grade (But Didn’t)

If you’ve got kids, let them read this. If you are someone’s kid — read this twice.

The truth is, we should’ve all had this talk by fourth grade. Yeah, I said it. Not in college. Not after your first paycheck. By the time you learned how to add and subtract, you should’ve learned how to save, invest, and not go broke.

This past weekend, I ended up giving a full-blown financial mentoring session to my daughter’s college friends. They were visiting, hanging out, enjoying the beach — and suddenly I found myself sitting in the middle of a group of smart young adults asking me how money actually works.

Let me tell you something: these kids are sharp — engineers, nurses, all of that. But financially? Clueless. And that’s not their fault. That’s the system’s fault.

So here’s what I told them. And if you're a parent, you need to share this with your kids. If you're in your 20s, write this down. And even if you're in your 40s, 50s or 60s and you're still broke — that just means you’re still in the “learning phase.”

Let's fix it now.

1. If Your Job Offers a 401K Match — TAKE THE MATCH.

I don’t care if it’s 3%, 4%, 5% — if your company is willing to give you free money, take it.

You wouldn’t leave free Chick-fil-A on the table. Don’t leave free retirement money either.

2. Your 20s Are For Habits, Not Flexing.

You're gonna be broke in your 20s. Most people are.

But it’s not about the money you're making — it's about the money habits you build. Live within your means. Don’t worry about impressing people. Build skills, not status.

I didn’t have TikTok or Instagram in my 20s. I wasn’t distracted by fake flexes and social media lies. That was my advantage. You gotta protect your focus.

3. Pay Yourself First. Then Figure Out Your Bills.

Most people make the mistake of figuring out how much their lifestyle costs... and then decide if there's anything left to save.

Wrong order.

Here’s how I do it:

10% to savings (I recommend a high-yield savings account like Ally)

10% to tithing (Because everything I’ve got comes from God — period.)

5-10% for fun (Yes, you should enjoy some of your money!)

10% into investments (If there’s no 401k, get a Roth IRA or something similar)

Then whatever’s left? That’s your living money. That’s your rent, your groceries, your Netflix. Learn how to live on that.

4. Start Saving So You Can Start Taking Advantage of Opportunities.

You want to take a course? Hire a mentor? Buy a camera? Join a program that teaches you how to build a business?

Cool. That’s why you saved. So when the opportunity comes, you don’t have to say, “I wish I could… but I’m broke.”

You don’t need more income. You need better habits.

5. By 30, You Should Own Your First Piece of Real Estate.

I bought my first house at 25. But if I could go back, I wouldn’t have bought a single-family home.

I’d get a duplex. Something I could live in on one side, and rent out the other. Someone else would help pay the mortgage. That's how wealth starts.

And every single person in that group — just like YOU — is capable of that.

6. Understand This: Compound Interest Is Either Working For You, Or Against You.

If you save and invest early — time becomes your best friend.

If you rack up credit card debt and make emotional money decisions — time becomes your worst enemy.

Automate what you can. Make it boring. Because emotional spending will wreck your finances faster than any bad investment.

Final Thought: You Don't Need to Be Rich — You Need to Be Ready.

This isn’t about being flashy.

This is about knowing how to manage the little, so God can trust you with the big.

Your 20s (or your “broke” phase, whenever it hits) is the test. Can you be wise with small? Can you be disciplined when nobody's watching?

Because if you can… your 30s, 40s, 50s and beyond will look real different.

And hey — maybe no one taught you this stuff when you were 10. But now you know. And now, it’s your job to do better — and pass it on.

Much Love,

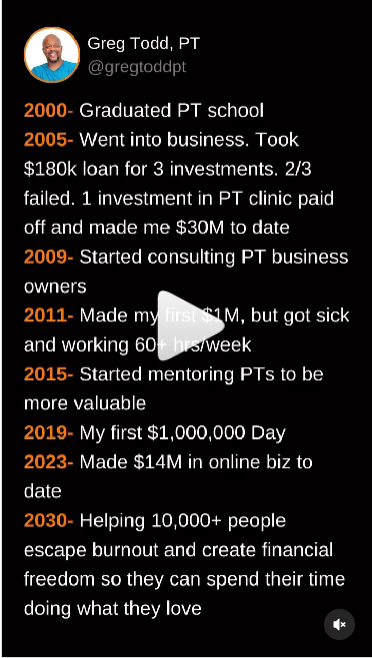

Greg Todd

Follow Greg on Socials:

https://www.Instagram.com/gregtoddpt

https://www.Facebook.com/gregtoddpt

Follow Greg on Instagram

Financial 101: The Talk You Should’ve Got in 4th Grade (But Didn’t)

Financial 101: The Talk You Should’ve Got in 4th Grade (But Didn’t)

If you’ve got kids, let them read this. If you are someone’s kid — read this twice.

The truth is, we should’ve all had this talk by fourth grade. Yeah, I said it. Not in college. Not after your first paycheck. By the time you learned how to add and subtract, you should’ve learned how to save, invest, and not go broke.

This past weekend, I ended up giving a full-blown financial mentoring session to my daughter’s college friends. They were visiting, hanging out, enjoying the beach — and suddenly I found myself sitting in the middle of a group of smart young adults asking me how money actually works.

Let me tell you something: these kids are sharp — engineers, nurses, all of that. But financially? Clueless. And that’s not their fault. That’s the system’s fault.

So here’s what I told them. And if you're a parent, you need to share this with your kids. If you're in your 20s, write this down. And even if you're in your 40s, 50s or 60s and you're still broke — that just means you’re still in the “learning phase.”

Let's fix it now.

1. If Your Job Offers a 401K Match — TAKE THE MATCH.

I don’t care if it’s 3%, 4%, 5% — if your company is willing to give you free money, take it.

You wouldn’t leave free Chick-fil-A on the table. Don’t leave free retirement money either.

2. Your 20s Are For Habits, Not Flexing.

You're gonna be broke in your 20s. Most people are.

But it’s not about the money you're making — it's about the money habits you build. Live within your means. Don’t worry about impressing people. Build skills, not status.

I didn’t have TikTok or Instagram in my 20s. I wasn’t distracted by fake flexes and social media lies. That was my advantage. You gotta protect your focus.

3. Pay Yourself First. Then Figure Out Your Bills.

Most people make the mistake of figuring out how much their lifestyle costs... and then decide if there's anything left to save.

Wrong order.

Here’s how I do it:

10% to savings (I recommend a high-yield savings account like Ally)

10% to tithing (Because everything I’ve got comes from God — period.)

5-10% for fun (Yes, you should enjoy some of your money!)

10% into investments (If there’s no 401k, get a Roth IRA or something similar)

Then whatever’s left? That’s your living money. That’s your rent, your groceries, your Netflix. Learn how to live on that.

4. Start Saving So You Can Start Taking Advantage of Opportunities.

You want to take a course? Hire a mentor? Buy a camera? Join a program that teaches you how to build a business?

Cool. That’s why you saved. So when the opportunity comes, you don’t have to say, “I wish I could… but I’m broke.”

You don’t need more income. You need better habits.

5. By 30, You Should Own Your First Piece of Real Estate.

I bought my first house at 25. But if I could go back, I wouldn’t have bought a single-family home.

I’d get a duplex. Something I could live in on one side, and rent out the other. Someone else would help pay the mortgage. That's how wealth starts.

And every single person in that group — just like YOU — is capable of that.

6. Understand This: Compound Interest Is Either Working For You, Or Against You.

If you save and invest early — time becomes your best friend.

If you rack up credit card debt and make emotional money decisions — time becomes your worst enemy.

Automate what you can. Make it boring. Because emotional spending will wreck your finances faster than any bad investment.

Final Thought: You Don't Need to Be Rich — You Need to Be Ready.

This isn’t about being flashy.

This is about knowing how to manage the little, so God can trust you with the big.

Your 20s (or your “broke” phase, whenever it hits) is the test. Can you be wise with small? Can you be disciplined when nobody's watching?

Because if you can… your 30s, 40s, 50s and beyond will look real different.

And hey — maybe no one taught you this stuff when you were 10. But now you know. And now, it’s your job to do better — and pass it on.

Much Love,

Greg Todd

Follow Greg on Socials:

https://www.Instagram.com/gregtoddpt

https://www.Facebook.com/gregtoddpt

Follow Greg's stories to learn more about what happens in the SSHC world.